Tim Curtis Director of International Operations for Executive Risk Solutions will be discussing the challenges, opportunities and management of risks when operating in Pre Frontier Markets in the next 6 weeks. Make sure you follow our page to get ERS insights on the difficulty of entering emerging but unstable markets.

Part 1: Pre Frontier Markets- Context, Definition and Description

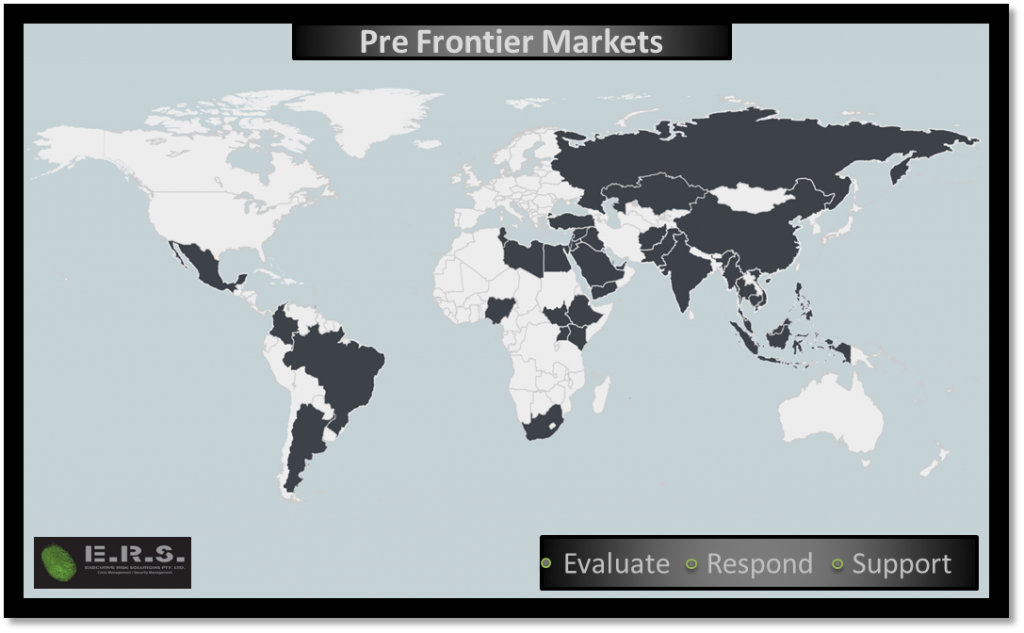

In the pursuit of opportunity and growth multinational organisations are leveraging the globalized environment and increasingly seeking to enter more challenging markets. The competitive nature of more established markets are requiring businesses to look to ‘pre- frontier markets’. These locations have been most rapidly, but not exclusively, presenting themselves in the Middle East, Central Asia and Africa.

So what defines a pre-frontier market?

Firstly, frontier markets are the first stage of an emerging market, which typically holds lower liquidity and demonstrates some early growth and industrialization whilst holding higher levels of volatility. Countries such as Argentina, Bulgaria, Colombia, Cote d’Ivoire, Ecuador, Kenya and Laos are all characterized as frontier markets.

Pre-frontier markets are the younger brothers of frontier markets. They can be categorized as having most or all of the key tenets of volatility including political instability, weak rule of law and a lack of efficacy in its security apparatus. Sectarian divides will be evident. Corruption will be widespread and will likely permeate all levels of government. Local communities will be absorbed by high levels of poverty and unemployment and in these communities there will be a poor quality of infrastructure and utilities. Literacy and general education levels will be low and health and environmental challenges will be high. Even the most simple of procurement solutions will be difficult with supply chains being highly complex. Large amounts of ungoverned spaces will also exist which create freedoms of movement and action for criminal, factional and anti government groups. Iraq, Afghanistan, Libya, Sierra Leone and Myanmar are all prominent examples of pre frontier markets.

Pre-frontier markets possess some of most extreme characteristics of instability and hence insecurity. They hold the potential to transition to being frontier markets and ultimately into emerging markets. They also have the propensity to slide into failed nation states and conflict economies.

Next week, Tim will discuss the Risk Identification and Reward Tradeoff of Pre Frontier Markets. Make sure you follow our page to not miss out.

Please contact ERS if you require further advice or if you would like us to assist with travel security +61 8 6109 0115 .

If you require immediate assistance please contact ERS247 on 1800 ERS 247 ERS247@executiverisksolutions.com.au